Welcome to Ganik Market Strategies LLC

Max Ganik

Equities Trader,

SMB Capital

____________________

University of Michigan

Ross School of Business

2019

Founder and Writer,

Ganik Market Strategies LLC

Option Millionaires

Director of

Diamond+ Trading Service

Staff

Market Technicians Association

Contributor, Instructor

Investopedia

Intern

TrueEX

Named #17th

“Top People in Finance to Follow on Twitter”

by TradeFollowers

Connect with

Ganik Market Strategies LLC

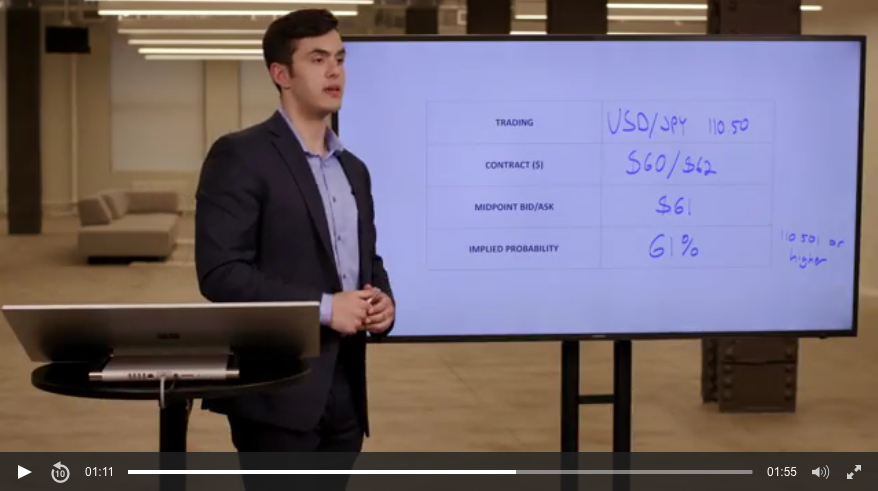

Investopedia Academy: Binary Options Trading

Binary Options can be risky, but we’ll teach you how to manage the risks and which technical indicators give you edge you need in today’s fast-moving market.

You’ll learn

-

What Binary Options Are

-

A Trading System

-

Risk management Techniques

-

Technical Indicators

-

Max’s Personal Strategies

Click HERE for more details and to register.

CNBC Fast Money Interviews with Melissa Lee

May 16, 2016:

Video Replay

Another awesome time at CNBC Fast Money, May 16, 2016

Another awesome time at CNBC Fast Money, May 16, 2016

Left to right: Tim Seymour, Karen Finerman, Steve Grass, Max Ganik, Melissa Lee, Pete Najarian

March 6, 2014:

Video Replay

What an awesome time on CNBC Fast Money, March 6, 2014

What an awesome time on CNBC Fast Money, March 6, 2014

Left to right: Dan Nathan, Tim Seymour, Max Ganik, Melissa Lee, Jon Najarian, Karen Finerman

View Max Ganik’s N.Y. Times interview on the Twitter stock, December 30, 2013:

“Rise in Twitter’s Stock Reflects Exuberance in Silicon Valley”

Scroll through slides below.